Complementary insurance is the second-largest source of funding for healthcare expenditure in France

In France, nearly of the population (96%) have complementary health insurance to cover cost sharing in the Social security system. This complementary insurance is mainly privately managed and is the second-largest financer of healthcare after compulsory health insurance. About 400 organizations (272 mutual insurance organisations, 100 insurance companies, and 25 provident institutions) paid out a total of 29.7 billion euros in benefits for medical care and goods in 2022 (which represents 12.6% of healthcare expenditure, 80% being financed by the Social security). On the one hand, complementary health insurance cover the copayments left after reimbursement by compulsory health insurance, which account for half of out-of-pocket expenses. On the other hand, they also cover, to varying degrees depending on the plan, the other part of out-of-pocket expenses, made up of extra-fees charged by health providers. These are highly concentrated: 45% of patients have none at all over the year, whereas they represent an average of 1,440 euros for the 10% with the most.

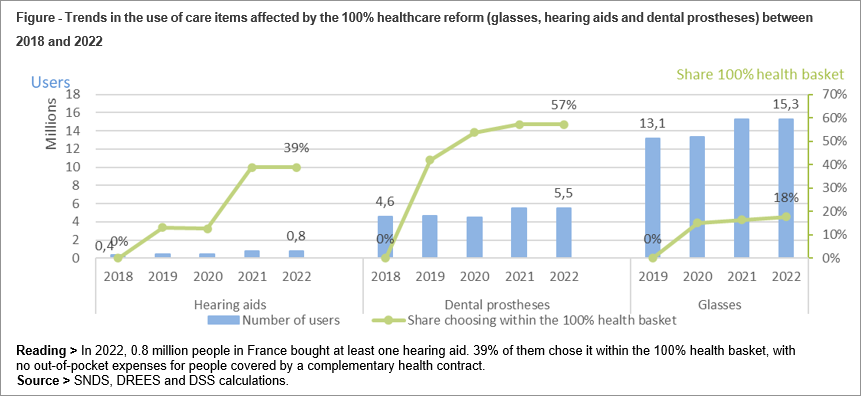

The 100% health care reform has increased the uptake of hearing aids and dental prostheses

Phased in between 2019 and 2021, the 100% health care reform has made available a basket of goods with no remaining out-of-pocket costs for glasses, dental prostheses, and hearing aids. Between 2019 and 2021, the number of people purchasing hearing aids rose significantly (+75%), with almost 40% of users choosing a product from the 100% health basket in 2021 (see figure below). Dental prosthesis purchases have risen by 17%, with 57% of users choosing a good within the 100% health basket. For glasses, on the other hand, only 18% of people who bought an equipment in 2022 opted for the 100% health basket; in 2019, most of the insured population already benefited from higher levels of coverage by their complementary plan than those subsequently imposed by the reform. Apart from these three categories of care, the level of coverage provided by complementary plans remained stable between 2019 and 2021.

Complementary healthcare companies and organizations are the main source of funding for these three categories of care, and expenses are rising (from 54% to 61% of spending between 2018 and 2022). However, spending financed by compulsory health insurance has also increased (from 14% to 18%). As a result, the share of out-of-pocket expenses for the households drops from 32% in 2018 to 21% in 2022 for these three categories of care.

Pricing increases sharply with age for individual plans

The level of risk to insure (after reimbursement by compulsory health insurance) rises sharply with age: in 2021, it reaches more than 1,000 euros on average per year over the age of 80, compared with 250 euros between the ages of 20 and 29. At any given age, people with long-term conditions have a risk to cover that is comparable to the rest of the population. This is because the so-called ALD (affections de longue durée) scheme, which leads compulsory health insurance to cover 100% of the cost of healthcare for chronic and costly conditions, compensates for their exposure to much higher healthcare costs.

The increasing risk for older people is reflected in the premiums paid for individual plans, which cover most of the older population. For a "benchmark" policyholder, the monthly premium for an individual policy is 33 euros on average at age 20, compared with 146 euros at age 85, with significant disparities depending on the level of coverage. Collective plans (mainly employer-sponsored plans), which cover a younger population on average and offer better coverage, have a more solidarity-based pricing system: it does not depend on age, and takes income into account more frequently than individual plans.

Despite higher reimbursements by compulsory and complementary health insurance, the elderly face final out-of-pocket expenses almost three times higher than those of younger people: 590 euros per year, on average in 2019, for households in which the oldest member is aged 70 or over, compared with 206 euros per year for those whose members are under 40.

12% of the most disadvantaged people are not covered, despite the reform of the complementary health insurance scheme (CSS) for the most modest.

Although 96% of the population is now covered by complementary health insurance, uninsurance is more frequent among the most precarious people. It affects 12% of people aged 15 or over in the lowest tenth of the income scale, and is more common among low-income pensioners and the unemployed.

Since November 1st 2019, the complementary health insurance (CSS) has replaced, for low-income households, the complementary universal health coverage (CMU-C) and the aid for the payment of a complementary health insurance (ACS), in order to simplify and increase the uptake to this public aid. The CSS now covers 11% of the population (7.4 million people by 2022), but only 56% of those eligible actually use it. The use of hearing aids, dental prostheses, and optics, for which the reform has given access to a wider basket of care with zero out-of-pocket expenses, has improved, particularly for former ACS beneficiaries (33% of them having used a dental prosthesis, hearing aid or optics in 2021 compared with 25% in 2018).

About the book

Complementary health care - Stakeholders, beneficiaries, coverage (La complémentaire santé – Acteurs, bénéficiaires, garanties) - Edition 2024

This third Panorama de la complémentaire santé updates the results of the 2016 and 2019 editions, and describes the scope of complementary healthcare, its stakeholders, and the coverage of the French population.

The effects of recent reforms designed to improve access to and coverage of complementary health insurance are highlighted. This new edition additionally includes an evaluation of two reforms deployed since 2019: the reform of 100% health in optics, audiology and dentistry, and the reform of complementary health insurance (CSS).

This edition also sheds new light on complementary health insurance organizations and companies in a context of increasing market concentration and growing regulation, as well as on the risks to be covered by complementary health insurance and households.

Numerous administrative and survey data are mobilized. The latter are collected from complementary health insurance organizations, households and companies and their employees; data on health care consumption comes from the French National Health Insurance Data (Système national des données de santé, SNDS).

This panorama includes the main findings of the latest annual report on the financial situation of supplementary health insurance organizations.